The Hidden Risk Most Inventory Investors Ignore: Timing Mismatch, Not Product Failure

The most common breakdown happens quietly — when capital timing and retail cash flow fall out of sync.

Tools designed to support structured inventory participation.

Participate in defined inventory cycles with clear entry amounts and timelines!

Convert supported branded gift cards into inventory purchasing power.

Use approved cards, transfers, or platform balance to participate.

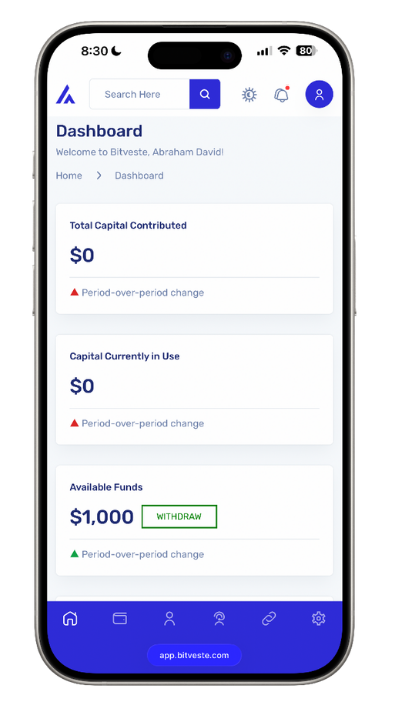

Monitor allocation status and settlement periods in one dashboard.

Clear disclosures, defined terms, and allocation-level visibility.

Inventory opportunities across multiple regions and retail sectors.

Bitveste brings inventory participation, branded purchasing power, and flexible funding tools into a single, transparent investment platform.

Allocate capital into clearly defined retail and wholesale inventory cycles.

Each allocation includes fixed entry terms, cycle duration, settlement timelines, and projected returns—tracked from funding through liquidation.

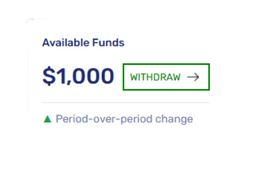

View real-time allocation status, cycle progress, and settlement outcomes in one dashboard.

Track deployed capital, realized returns, pending settlements, and historical performance across all inventory cycles.

Get Started

The most common breakdown happens quietly — when capital timing and retail cash flow fall out of sync.

Most first-time investors approach retail inventory the same way they approach startups or stocks. That is a mistake.

Bitveste intentionally avoids promising fixed returns — not because outcomes are unclear, but because retail performance is conditional, not contractual.

For store owners and merchants with verifiable documentation, Bitveste offers structured capital allocation tied to inventory cycles. Schedule a call with our team to discuss fit and next steps.

Schedule Consultation